The Indian stock market opened higher on June 24 after a ceasefire announcement in a global conflict zone triggered positive global cues. Investors responded positively to reduced geopolitical tension. However, the optimism did not last long as concerns about inflation and interest rates once again caused selling pressure in mid-session trades.

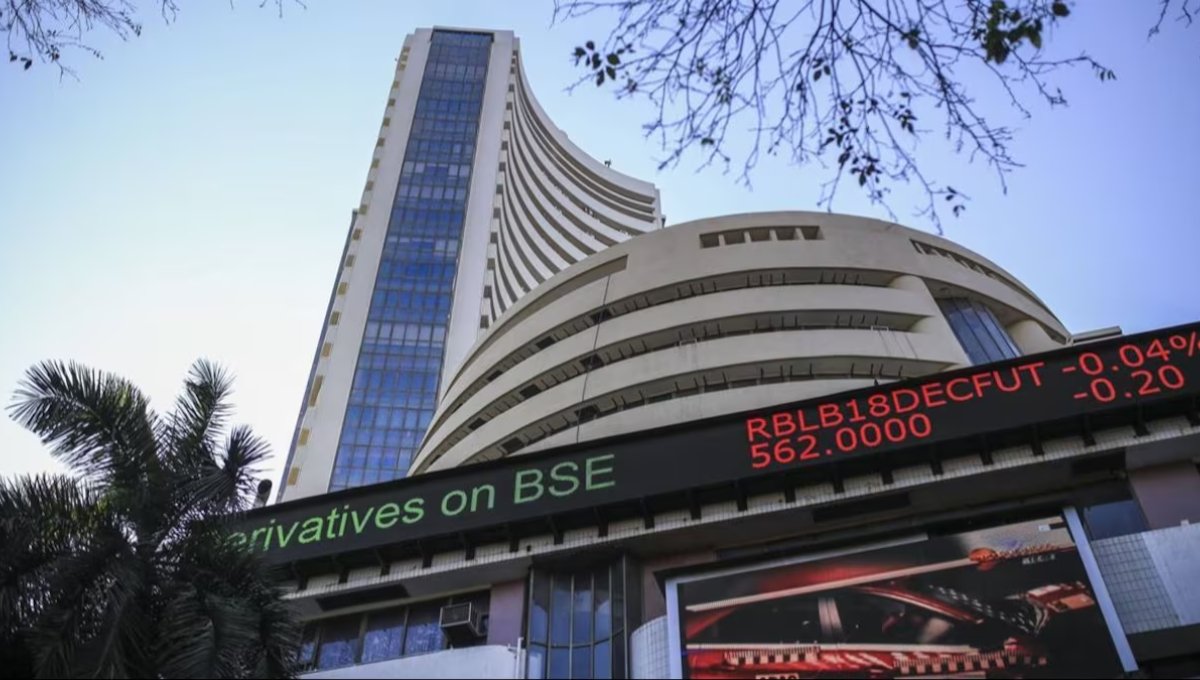

Nifty and Sensex Performance

The Nifty 50 started the session above the 23,600 mark and crossed 23,700 in early gains, while Sensex surged over 300 points in the opening hour. But as the session progressed, volatility increased, and both indices lost momentum. Banking and metal stocks were the top gainers in early trade, whereas IT and FMCG stocks dragged the indices lower by noon.

Sector-Wise Movement and Investor Focus

Shares in the PSU banks, energy, and auto sector showed positive movement while weakness was visible in pharma and FMCG stocks. Investors are closely tracking crude oil prices and foreign institutional investor (FII) activity. The market is also awaiting fresh domestic economic data expected later this week. Traders remain cautious due to lack of strong triggers.

Global Factors and Closing Outlook

Global markets were mixed, with Asian markets posting mild gains and European futures indicating a flat start. The ceasefire news gave temporary relief, but uncertainty around US Fed’s policy outlook and global growth concerns kept investors in check. Market participants expect range-bound movement in the short term unless new developments emerge.